The year 2018 marked a pivotal moment in the evolution of international financial transactions with the launch of One Pay FX by Santander. This application, built on Ripple’s xCurrent, represented a pioneering effort to leverage blockchain technology for real world financial applications. The introduction of One Pay FX was not merely a technological upgrade, it signified a shift towards greater transparency, efficiency, and customer empowerment in the traditionally complex and often opaque realm of international money transfers.

Prior to One Pay FX, international money transfers were typically characterized by high fees, slow processing times, and a lack of transparency regarding the total cost and delivery time. Traditional methods often involved a network of intermediary banks, each taking a cut and adding to the overall transaction time. This system was particularly burdensome for individuals and small businesses that frequently sent money across borders.

One Pay FX addressed these pain points by utilizing Ripple’s xCurrent, a blockchain based enterprise software solution designed to facilitate faster and more transparent cross border payments. XCurrent does not use the XRP cryptocurrency directly for settlement but leverages blockchain technology for real time messaging and tracking of transactions. This allows banks to communicate with each other directly, reducing the need for intermediaries and streamlining the payment process.

The impact of One Pay FX was immediately felt by Santander’s customers. The app provided a user friendly interface that displayed the total cost of the transaction, including all fees and exchange rates, upfront. It also provided an estimated delivery time, giving customers greater control and predictability over their international transfers. Furthermore, the app offered same day transfers for certain currencies and destinations, a significant improvement over the traditional multi day processing times.

The launch of One Pay FX also had a broader impact on the financial industry. It served as a proof of concept for the potential of blockchain technology to revolutionize international payments. Other banks and financial institutions began to take notice of the efficiency and transparency offered by One Pay FX, prompting them to explore their own blockchain based solutions. This led to increased investment and innovation in the field of blockchain technology for financial applications.

Several individuals played a key role in the development and implementation of One Pay FX. Ana Botín, the Executive Chairman of Santander, was a strong advocate for innovation and technology within the bank. Her leadership and vision were instrumental in driving the development of One Pay FX and other digital initiatives. Ripple’s CEO, Brad Garlinghouse, also played a crucial role in providing the underlying technology and infrastructure for the app. His company’s xCurrent platform was the backbone of One Pay FX, enabling the secure and efficient transfer of funds across borders.

The introduction of One Pay FX was not without its challenges. Regulatory uncertainty surrounding blockchain technology and cryptocurrencies posed a significant hurdle. Banks and financial institutions had to navigate a complex and evolving regulatory landscape to ensure compliance with applicable laws and regulations. Another challenge was the need for interoperability between different blockchain networks and legacy systems. To fully realize the potential of blockchain technology for international payments, it was essential to establish standards and protocols that allowed different systems to communicate with each other seamlessly.

Despite these challenges, the adoption of blockchain technology for international payments has continued to grow in recent years. Several other banks and financial institutions have launched their own blockchain based payment solutions, further validating the potential of this technology. For example, JP Morgan Chase launched its own blockchain based payment system called Quorum, while Visa acquired Earthport, a company that provides cross border payment services using blockchain technology.

Looking ahead, the future of blockchain technology for international payments appears bright. As regulatory clarity increases and interoperability improves, we can expect to see even wider adoption of this technology. Blockchain technology has the potential to make international payments faster, cheaper, and more transparent for everyone. This could have a significant impact on global trade and economic development, particularly in emerging markets where access to traditional financial services is limited.

One potential future development is the increased use of stablecoins for international payments. Stablecoins are cryptocurrencies that are pegged to a stable asset, such as the US dollar. This makes them less volatile than other cryptocurrencies, making them more suitable for use in everyday transactions. Several companies are already experimenting with the use of stablecoins for cross border payments, and this trend is likely to continue in the coming years.

Another potential development is the integration of blockchain technology with other emerging technologies, such as artificial intelligence (AI) and the Internet of Things (IoT). AI could be used to automate various aspects of the international payment process, such as fraud detection and compliance. The IoT could be used to track goods and payments in real time, providing greater transparency and accountability.

The launch of Santander’s One Pay FX in 2018 marked a significant milestone in the evolution of international payments. This pioneering application demonstrated the potential of blockchain technology to revolutionize the way money is transferred across borders. While challenges remain, the adoption of blockchain technology for international payments is expected to continue to grow in the years to come, leading to a more efficient, transparent, and inclusive global financial system. The vision and leadership of individuals like Ana Botín and Brad Garlinghouse, coupled with the ongoing innovation in the field of blockchain technology, are paving the way for a future where international payments are seamless and accessible to all. The development of One Pay FX serves as an important case study for other financial institutions looking to embrace blockchain technology and improve their cross-border payment services. By focusing on customer needs and leveraging the power of blockchain, banks can create innovative solutions that drive efficiency, transparency, and financial inclusion.

Summary

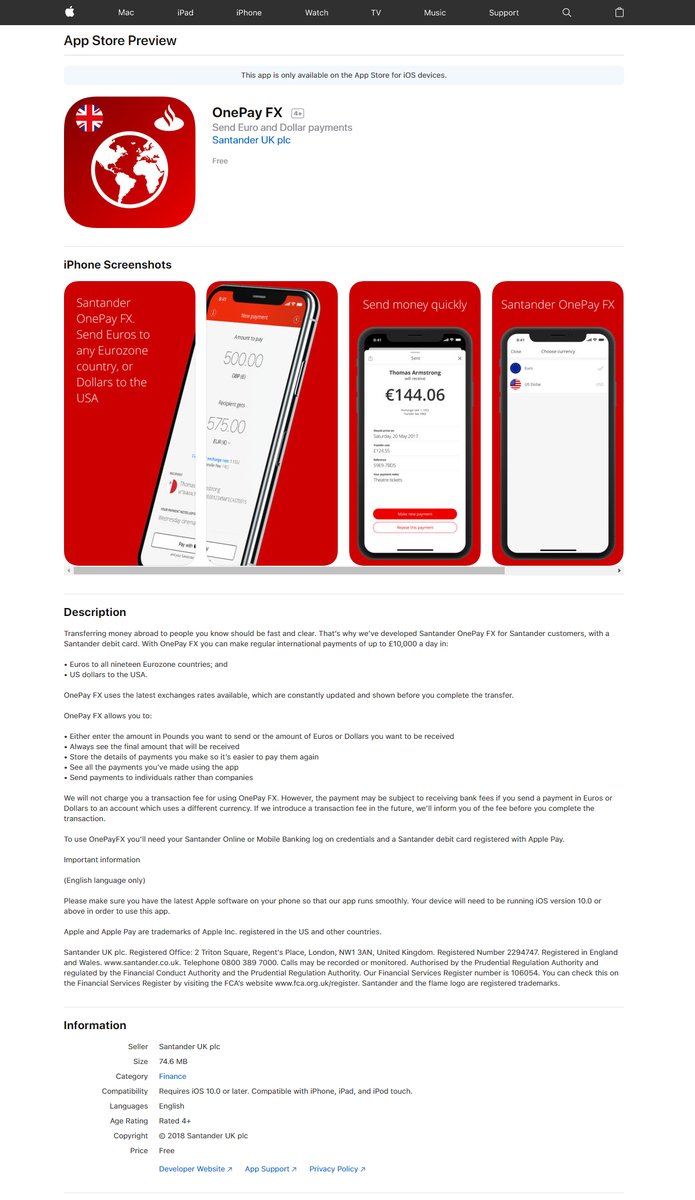

U.K. Santander Bank announced it’s World’s First Blockchain-Based Mobile App for transferring its customer payments through Ripple’s Network to Europe and United states.

Its app called One Pay FX enables Santander’s Bank 133 Million Customers to send international Euro & USD transfers by in the same day.

One Pay FX is the first Blockchain-based mobile App have a great friendly User Interface that provide :

- Total cost of the Transaction ( Bank fees & Exchange rates )

- Exact delivery time

- Payment receipt

Here is the First Live Revolutionary Transaction by xCurrent RippleNet Services announced by Santander Bank :